Making sense of health insurance

So, what’s the ACA?

Understand the costs associated with a plan

The cost of your health insurance depends on your monthly premium, deductible, and out-of-pocket max. It’s important to know these costs upfront because they vary across plans and will impact what you owe.

Premium

The fixed monthly fee you’ll pay for your health insurance plan.

Copayment

A fixed dollar amount you’re responsible for paying for a covered service.

Coinsurance

How much you owe for a covered service after your plan pays their share.

Deductible

The amount spent on certain covered services before your plan starts paying for care.

Out-of-pocket maximum

The maximum amount you’ll pay for covered health care services during the plan year.

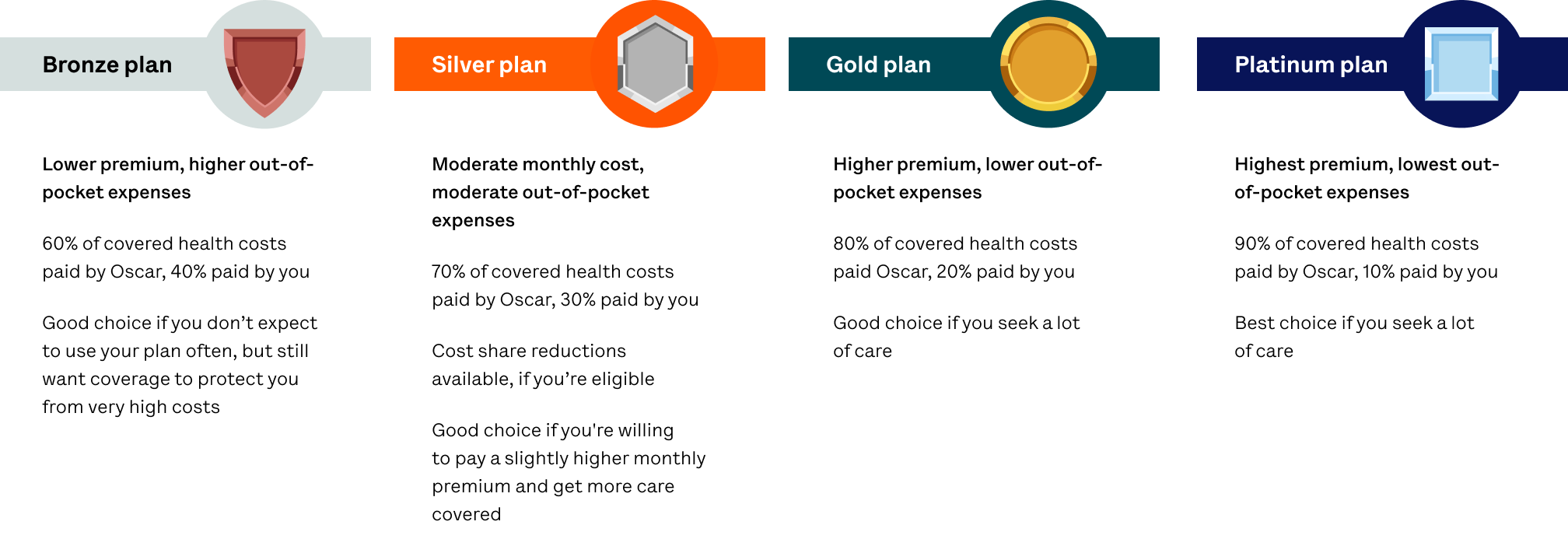

Choosing a health plan tier

The Marketplace categorizes plans into metal tiers: Bronze, Silver, Gold, and Platinum. You will receive the same quality of care and the same benefits for all tiers. The difference between them is the monthly premium and the amount you’ll pay for care.

*Oscar's Platinum plans are only available in New York state.

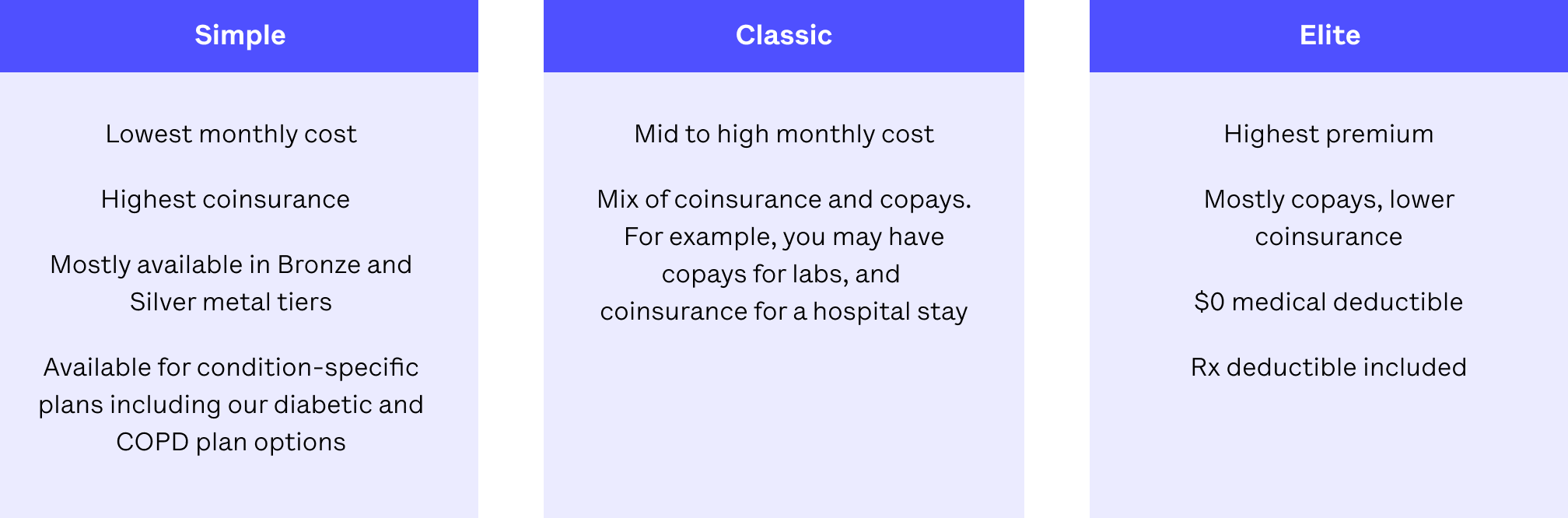

Selecting a plan type

Within each metal tier, Oscar offers 3 plan types, or suites: Simple, Classic, and Elite. The difference between them is the breakout of coinsurance and copays.

*Bronze Elite plans feature $0 medical deductibles but may have a separate Rx deductible.

Ways to save on health insurance

Health insurance can be expensive. But going without it can be more expensive in the long run. Here are some ways to save:- Premium tax credits

- Cost sharing reductions

- Cost-sharing reductions (CSRs) are another type of financial assistance, or subsidy, available to Marketplace enrollees. CSRs help lower the amount you pay for copays, coinsurance, and deductibles. You qualify for the cost-sharing reduction if your estimated annual household income falls within certain guidelines of the Federal Poverty Level. Unlike the premium tax credit, which can be applied toward any metal level of coverage, cost sharing reductions are only offered through Silver plans.

- Use in-network providers

- Once you enroll in a plan, ensure that you receive care from providers that are in-network. Providers in our network have already agreed to our negotiated rates. Even if you have a deductible and have to pay out-of-pocket for some care, you'll still get the benefit of paying Oscar's lower rates. Also, any payments you make for covered services with in-network doctors will be credited toward your deductible and out-of-pocket maximum. You can find in-network care at hioscar.com/care-options.

- Know where to go for care

- If you have a minor health issue, visit your in-network primary care provider. You can talk to a healthcare provider anytime using Virtual Urgent Care. They can provide immediate care for urgent problems like pink-eye, skin issues, minor sprains, bruises, flu, or a sore throat. Only visit the emergency room if you have a life-threatening emergency. You can find in-network care at hioscar.com/care-options.

- Use your covered preventive care services

- All Oscar plans cover preventive care at no cost to you when you visit an in-network doctor. Preventive care includes annual checkups, screenings, vaccines, and more. That’s a great way to stay on top of your health and save at the same time. Find out more about the essential health benefits covered by Oscar, which includes preventive care and more. Find an in-network provider at hioscar.com/care-options.

How & when to enroll in a health plan

Enrollment options

- Visit hioscar.com/individuals

- Call your broker

- Go to healthcare.gov or your state’s health insurance marketplace

Enrollment timelines

Every year, you can buy health insurance, switch plans, or renew your plan through the Marketplace during the Open Enrollment Period. This period typically lasts from November 1 to January 15, depending on where you live. After the Open Enrollment Period ends, the Special Enrollment Period begins. You qualify for a Special Enrollment Period if you experience a qualifying life event, such as losing health coverage, moving, getting married, or having a baby. Depending on your Special Enrollment Period type, you will have 60 days from the event to choose new coverage. You can enroll in Medicaid or the Children’s Health Insurance Program (CHIP) at any time.

Oscar members enjoy access to affordable, convenient care

Here's what you'll love as an Oscar member:

Great providers nearby

Find doctors, hospitals, and pharmacies near you that accept our plans. See providers that understand your language, race, ethnicity, and health history.

A supportive Care Team

Your Care Team will help you find virtual or local providers, give cost estimates for care, and offer support whenever you need it.

Virtual care anywhere

Enjoy virtual care from the comfort of your home, at work, or on-the-go. All Oscar plans include Oscar Care, which has $0 Virtual Urgent Care¹ and, in some places, $0 Oscar Primary Care.²

Savings with $3 meds

Many commonly prescribed prescription drugs are as little as $3.³ Get a prescription or refill through the Oscar app, and get it delivered right to your door.

$0 preventive care

Your plan fully covers preventive care. That means your annual checkup, vaccines, or screenings (like blood pressure or cholesterol) are all $0.

An app at your fingertips

Get care, refill prescriptions, message your Care Team, and look up benefits — all on-the-go with the Oscar app.